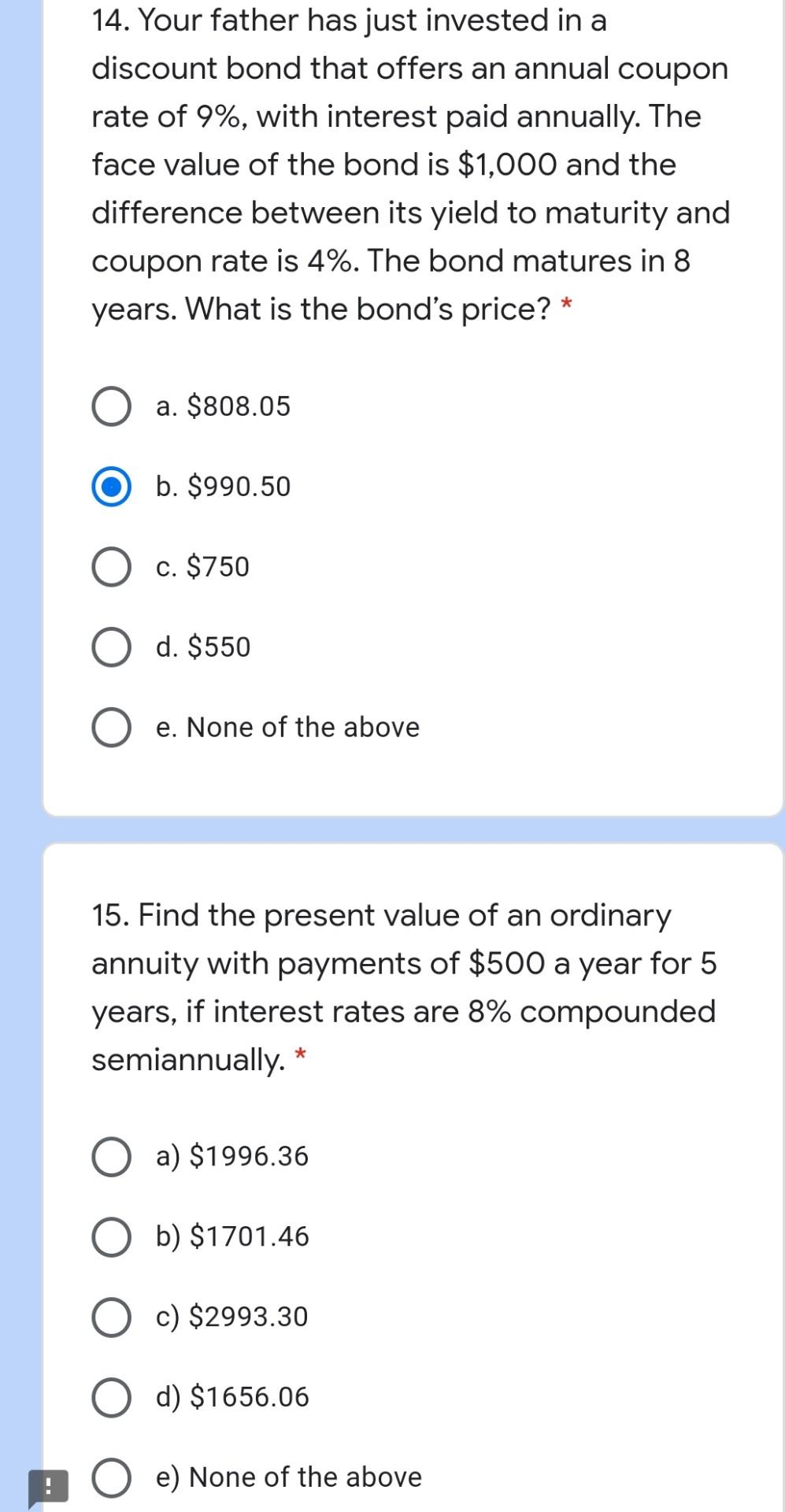

43 difference between yield to maturity and coupon rate

Understanding Coupon Rate and Yield to Maturity of Bonds The Yield to Maturity is a rate of return that assumes that the buyer of the bond will hold the security until its maturity date and incorporates the rise or fall of market interest rates. This will be a bit technical. ... Coupon Rate: Maturity Date: Coupon Frequency: YTM: Face Value: Clean Price: Market Value: RTB 03-11: 2.375%: 3/9/2024: 4: 2 ... Yield to Maturity - YTM vs. Spot Rate. What's the Difference? A bond's yield to maturity is based on the interest rate the investor would earn from reinvesting every coupon payment. The coupons would be reinvested at an average interest rate until...

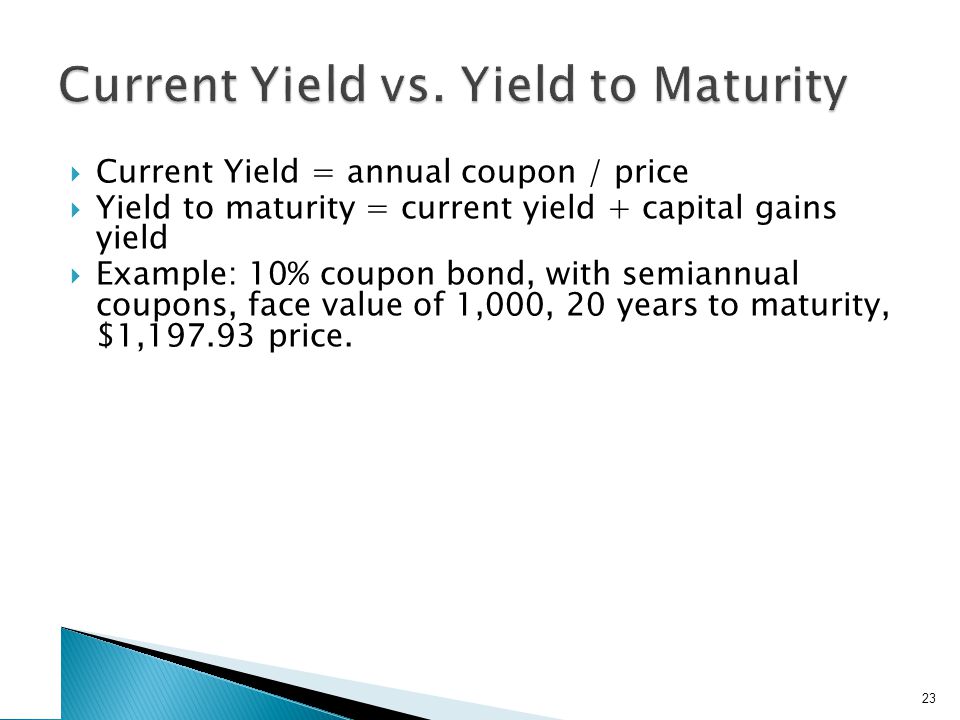

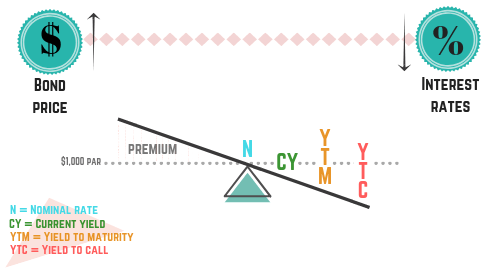

Coupon vs Yield | Top 8 Useful Differences (with Infographics) - EDUCBA 3. Interest rates influence the coupon rates. The current yield compares the coupon rate to the market price of the bond. 4. The coupon amount remains the same until maturity. Market price keeps on fluctuating, better to buy a bond at a discount which represents a larger share of the purchase price. 5.

.png)

Difference between yield to maturity and coupon rate

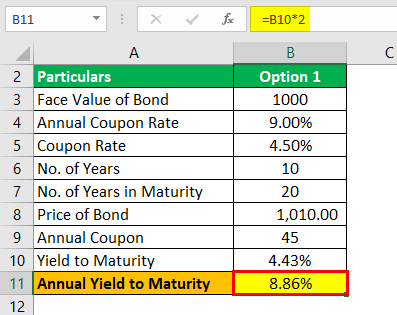

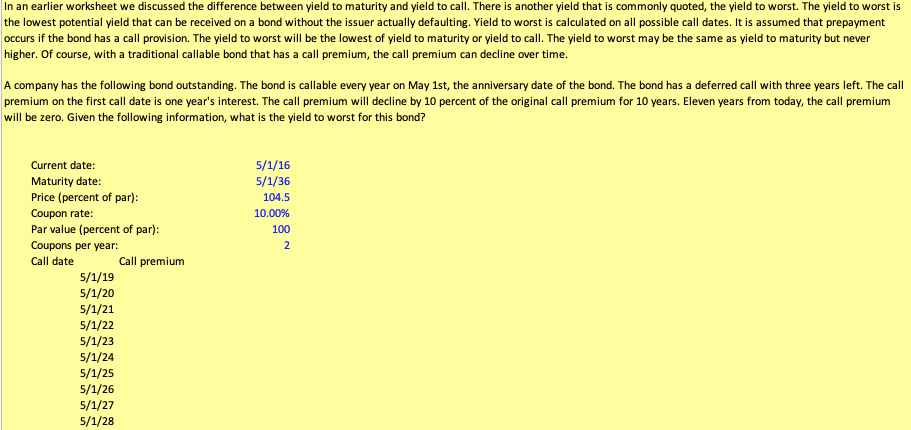

Yield to Maturity vs Coupon Rate: What's the Difference While the coupon rate determines annual interest earnings, the yield to maturity determines how much you'll make back in interest throughout the bond's lifespan. The YTM considers market changes because, even though your bond's interest rate will not change, its value will fluctuate depending on the market's rates. Current Yield vs. Yield to Maturity - Investopedia Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until its maturation date. Bond Basics When a bond is issued, the issuing entity determines its duration,... What Is the Difference Between Coupon Rate and Yield-To-Maturity ... Yield-to-maturity (YTM), as the name states, is the rate of return that the investor/bondholder will receive, assuming the bond is held until maturity. YTM accounts for various factors like coupon rate, bond prices, and time remaining until maturity, as well as, difference between the face value and price.

Difference between yield to maturity and coupon rate. Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held … Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion Difference Between Yield to Maturity and Coupon Rate The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. CONTENTS 1. What is the difference between yield to maturity and the coupon rate ... A: A bond's coupon rate is the actual amount of interest income earned on the bond each year based on its face value. A bond's yield to maturity (YTM) is the estimated rate of return based on the assumption that it will be held until its maturity date and not called. Yield to maturity includes the coupon rate within its calculation, and in ...

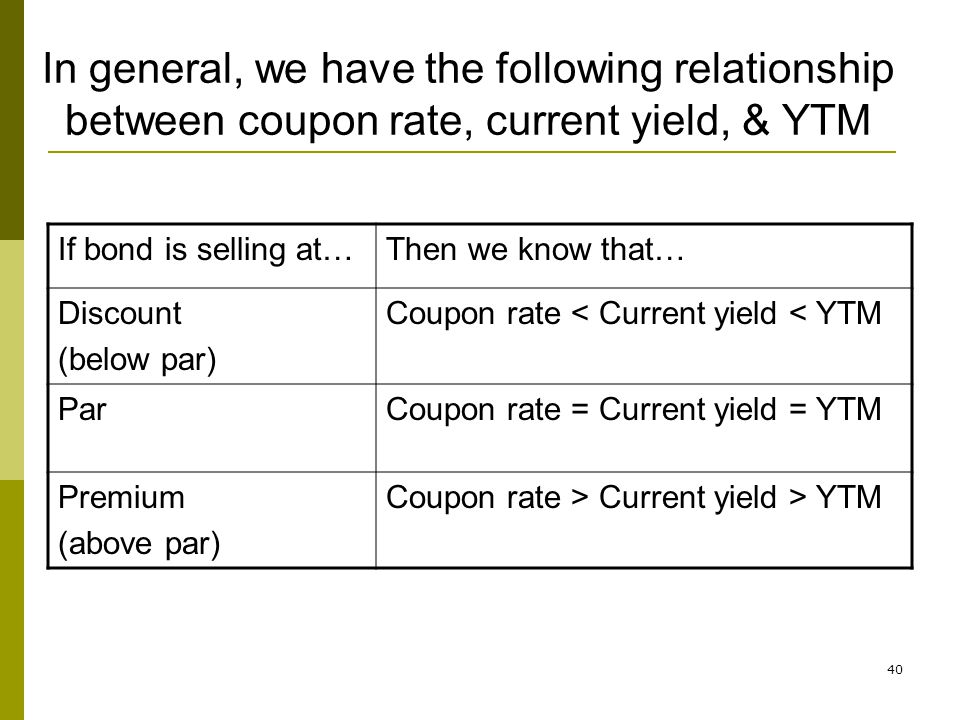

Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate. Difference Between Yield & Coupon Rate The higher the rate of coupon bonds, the higher the yield rate. 4.The average coupon rate gathered in a number of years determines the yield rate. 5.Aside from the coupon rate, yield is also influenced by price, the number of years remaining till maturity, and the difference between its face value and current price. Yield to Maturity vs. Holding Period Return: What's the Difference? Yield to maturity (YTM), also known as book or redemption yield, reflects an investor's yield for holding a bond until it matures. It does not account for taxes paid by the investor or... Difference between YTM and Coupon Rates A YTM, or yield-to-maturity, reflects the annual return an investor would receive if they held a bond until it matures. A coupon rate is the percentage of the face value of a bond that is paid out as interest to investors on a yearly basis. The higher the coupon rate, the more money investors will earn on their investment.

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The yield to maturity is the estimated annual rate of return for a bond assuming that the investor holds the asset until its maturity date and reinvests the payments at the same rate. 1... Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%.... Difference Between Coupon Rate and Yield to Maturity The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year. Current Yield vs. Yield to Maturity: What's the Difference? That's why the yield to maturity is only 2.99%. In contrast, the XYZ 3.15% bond's current market price is $980, a discount to the $1,000 face value. Its current yield of 3.2% and its yield to maturity of 3.48% are higher than its coupon rate because of the discount. Note

What Is the Difference Between Coupon Rate and Yield-To-Maturity ... It is the amount that the bondholders will receive for holding the bond. Coupon payments are usually made semi-annually or quarterly. Yield-to-maturity (YTM), as the name states, is the rate of return that the investor/bondholder will receive, assuming the bond is held until maturity.

What Is the Difference Between Coupon Rate and Yield-To-Maturity ... Yield-to-maturity (YTM), as the name states, is the rate of return that the investor/bondholder will receive, assuming the bond is held until maturity. YTM accounts for various factors like coupon rate, bond prices, and time remaining until maturity, as well as, difference between the face value and price.

Current Yield vs. Yield to Maturity - Investopedia Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until its maturation date. Bond Basics When a bond is issued, the issuing entity determines its duration,...

Yield to Maturity vs Coupon Rate: What's the Difference While the coupon rate determines annual interest earnings, the yield to maturity determines how much you'll make back in interest throughout the bond's lifespan. The YTM considers market changes because, even though your bond's interest rate will not change, its value will fluctuate depending on the market's rates.

:max_bytes(150000):strip_icc()/shutterstock_112522391-5bfc2b9846e0fb0051bde2d3.jpg)

Post a Comment for "43 difference between yield to maturity and coupon rate"