43 zero coupon bond benefits

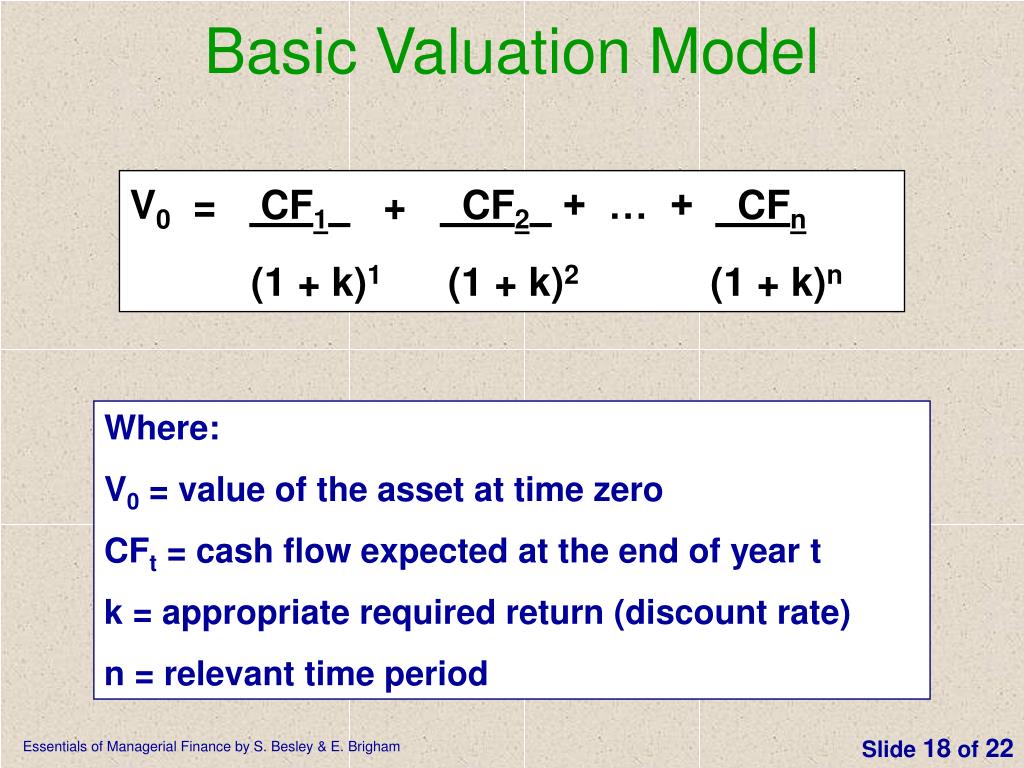

Microsoft Excel Bond Yield Calculations | TVMCalcs.com We know that the bond carries a coupon rate of 8% per year, and the bond is selling for less than its face value. Therefore, we know that the YTM must be greater than 8% per year. You need to remember that the bond pays interest semiannually, and we entered Nper as the number of semiannual periods (6) and Pmt as the semiannual payment amount ... Warrant (finance) - Wikipedia Warrants are issued in this way as a "sweetener" to make the bond issue more attractive and to reduce the interest rate that must be offered in order to sell the bond issue. Example. Price paid for bond with warrants ; Coupon payments C; Maturity T; Required rate of return r; Face value of bond F

Bond Yield to Maturity Calculator for Comparing Bonds The Coupon – This is simply the interest rate on the bond. It is called a ‘coupon', because originally there would be a paper coupon attached to the bond that the owner would tear off and redeem for their interest payments. Of course, these days most interest payments are tracked, and paid, electronically. Still, the term persists. The coupon is expressed as a percentage of …

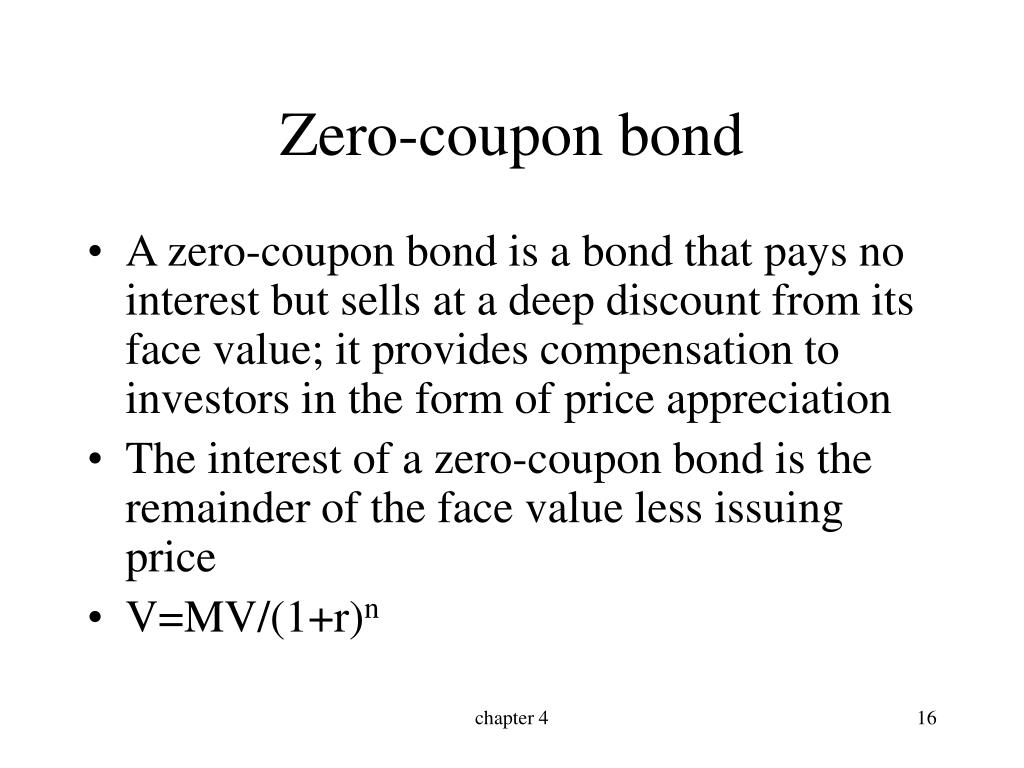

Zero coupon bond benefits

Convertible Bond Definition - Investopedia Oct 06, 2020 · Convertible Bond: A convertible bond is a type of debt security that can be converted into a predetermined amount of the underlying company's equity at certain times during the bond's life ... MC Explains | What is a 'zero-coupon, zero-principal' instrument? Jul 20, 2022 · With its zero-coupon, zero-principal structure, it resembles a debt security like a bond. When an entity takes a loan by issuing regular debt security like a bond, it has to make interest payments ... What Is the Face Value of a Bond? - SmartAsset 15.01.2020 · A bond’s coupon rate is the rate at which it earns these returns, and payments are based on the face value. So if a bond holds a $1,000 face value with a 5% coupon rate, then that would leave you with $50 in returns annually. This is in addition to the issuer paying you back the bond’s face value on its maturity date.

Zero coupon bond benefits. Government Bonds: Types, Benefits & How to Buy Government Bonds Zero Coupon Bonds As the name suggests, Zero Coupon Bonds earns zero interest i.e., no interest. The income generated from Zero-coupon bonds accrues from the difference in the issuance price at a discount and redemption value at par. These bonds are created from existing securities rather than issuing them through auction. Advantages and Risks of Zero Coupon Treasury Bonds Jan 31, 2022 · A zero-coupon bond is a debt security that doesn't pay interest but trades at a deep discount, rendering profit at maturity when it is redeemed. ... The Benefits and Risks of Being a Bondholder. How Bond Maturity Works - US News & World Report 12.03.2020 · Issuers may want to redeem the bond early if interest rates change in a way that benefits them. A callable bond may have a stated maturity of 30 years, but the issuer may have the opportunity to ... Zero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far.

Bonds & Rates - WSJ News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services. What Is the Face Value of a Bond? - SmartAsset 15.01.2020 · A bond’s coupon rate is the rate at which it earns these returns, and payments are based on the face value. So if a bond holds a $1,000 face value with a 5% coupon rate, then that would leave you with $50 in returns annually. This is in addition to the issuer paying you back the bond’s face value on its maturity date. MC Explains | What is a 'zero-coupon, zero-principal' instrument? Jul 20, 2022 · With its zero-coupon, zero-principal structure, it resembles a debt security like a bond. When an entity takes a loan by issuing regular debt security like a bond, it has to make interest payments ... Convertible Bond Definition - Investopedia Oct 06, 2020 · Convertible Bond: A convertible bond is a type of debt security that can be converted into a predetermined amount of the underlying company's equity at certain times during the bond's life ...

/97615498-56a6941c3df78cf7728f1cd4.jpg)

Post a Comment for "43 zero coupon bond benefits"