44 coupon rate of bond

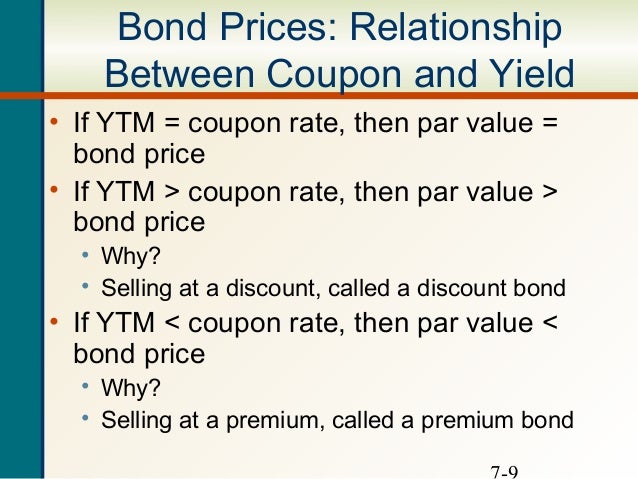

Coupon Rate of a Bond (Formula, Definition) | Calculate ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

› Zero_Coupon_Bond_ValueZero Coupon Bond Value - Formula (with Calculator) After 5 years, the bond could then be redeemed for the $100 face value. Example of Zero Coupon Bond Formula with Rate Changes. A 6 year bond was originally issued one year ago with a face value of $100 and a rate of 6%. As the prior example shows, the value at the 6% rate with 5 years remaining would be $74.73.

Coupon rate of bond

Individual - Treasury Bonds: Rates & Terms Treasury Bonds: Rates & Terms Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .) What Is Coupon Rate of a Bond | The Fixed Income | Bond ... A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment. Coupon Rate - Meaning, Calculation and Importance To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders.

Coupon rate of bond. Bond Coupon Interest Rate: How It Affects Price A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's... › finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jan 12, 2022 · For a plain-vanilla bond, the coupon rate of the bond does not change with the market interest rates - it is fixed when the bond is issued. However, bonds issued in a high-interest rate environment are more likely to have a higher coupon rate. Even when the interest rate goes down, the coupon rate What Is a Coupon Rate? And How Does It Affects the Price ... A zero-coupon bond is a bond without coupons, and its coupon rate is 0%. The issuer of zero-coupon bonds only pays the face value of bonds at the maturity date. Instead of paying coupon interest, the bond issuer issues the bonds at price less than the face value. The discount of issue effectively represents the interest and yield for investors ... Coupon Rate Definition & Example | InvestingAnswers The coupon rate on the bond is 5%, which means the issuer will pay you 5% interest per year, or $50, on the face value of the bond ($1,000 x 0.05). Even if your bond trades for less than $1,000 (or more than $1,000), the issuer is still responsible for paying the coupon based on the face value of the bond.

United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. Skip to content. Markets ... Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year . 0.13: 101.80- ... What Is Coupon Rate and How Do You Calculate It? A bond coupon rate is a fixed payment, meaning that it will remain the same for the lifetime of the bond. For example, you can purchase a 10-year bond with a face value of $100 and a bond coupon rate of 5%. Coupon Bond - Assignment Point The coupon rate is called the yield that the coupon bond pays on the date of its issuance. There may be adjustments in the value of the coupon rate. Toward the finish of the bond life, none of the coupons will remain and the bond testament can be gone into the bank or agent to gather the presumptive worth of the bond. Difference Between Coupon Rate and Discount Rate (With ... The standard worth is essentially the assumed worth of the bond or the price of the bond as expressed by the responsible substance. Subsequently, a $1,000 security with a coupon pace of 6% pays $60 in revenue yearly, and a $2,000 protection with a coupon pace of 6% pays $120 in revenue every year. What is Discount Rate?

› terms › bBond Definition Feb 23, 2022 · Discovery Bond: A type of fidelity bond used to protect a business from losses caused by employees committing acts of fraud. A discovery bond covers losses that are discovered while the bond is in ... Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link › terms › cCoupon Definition - Investopedia Apr 02, 2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value. Secured vs Unsecured Bonds - Key Differences and ... Generally, unsecured bonds offer a higher coupon rate than secured bonds. However, it is not a rule of thumb either. An investor should look collectively at different features on offer. A secured bond can offer higher coupon rates. Else, it will be offered at a discounted price on the par value of the bond. Either way, it will benefit the investor.

Coupon Rate of a Bond - Harbourfront Technologies Coupon Rate of a Bond = Total Annual Coupon Payment / Par Value of Bond x 100% For example, a bond offers a total annual coupon payment of $50. The bond's par value is $1,000. Therefore, its coupon rate will be 5% ($50 / $1,000 x 100). What are the uses of Coupon Rates? Almost every bond that investors may obtain will have a coupon payment.

What Is the Coupon Rate of a Bond? A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

What is Coupon Rate? Definition of Coupon Rate, Coupon ... Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

Coupon rate financial definition of Coupon rate Coupon rate. The coupon rate is the interest rate that the issuer of a bond or other debt security promises to pay during the term of a loan. For example, a bond that is paying 6% annual interest has a coupon rate of 6%. The term is derived from the practice, now discontinued, of issuing bonds with detachable coupons.

Bond Price Calculator Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value. Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly. Market interest rate represents the return rate similar bonds sold on the market can generate.

› coupon-rate-formulaCoupon Rate Formula | Calculator (Excel Template) Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following:

Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

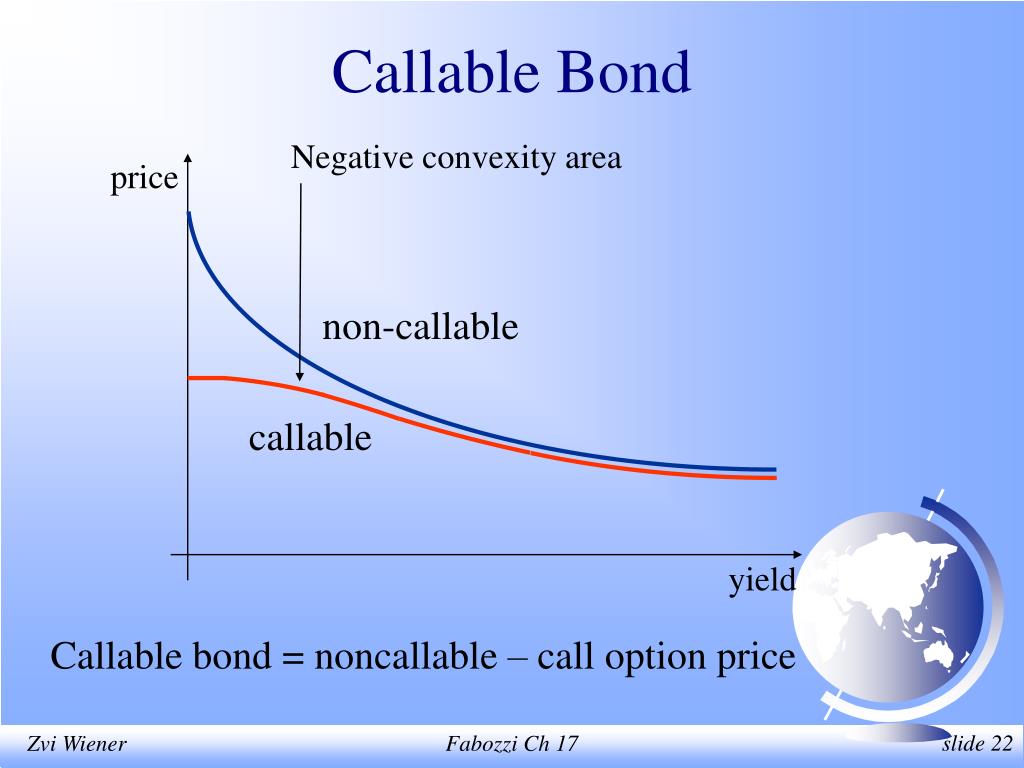

Definition Of Bond Discount Rate | KOVNER CENTER FOR ... Bond Discount Vs Coupon Rate. Bond investors earn returns from coupon payments and, if the bond was purchased at a discount, the increase in price as maturity approaches. Differences in discount rates reveal how the market views the bond's risk-adjusted returns. Yield to maturity is the rate of interest that an investor gets if the bond is ...

Post a Comment for "44 coupon rate of bond"