40 what is coupon for bond

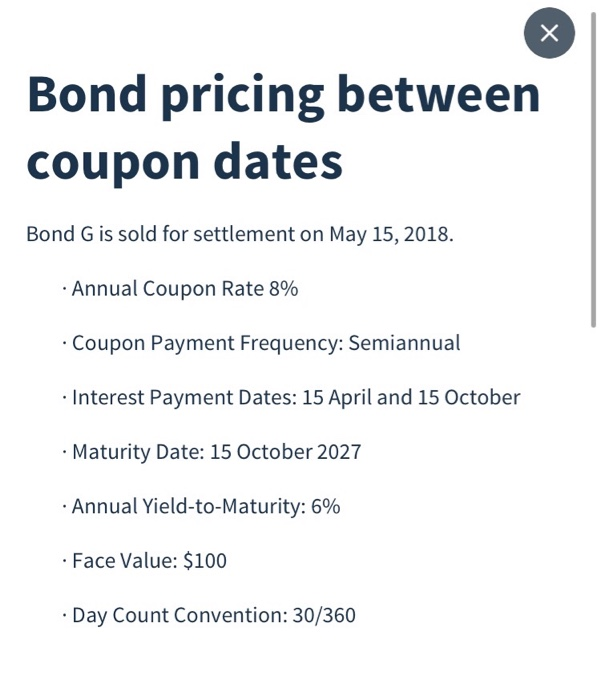

Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a percentage of its par value. The par value... How to Find Coupon Rate of a Bond on Financial Calculator The coupon rate is the percentage of a bond's par value paid as interest each year. Par value is the face value of the bond, which is the amount the bondholder will receive when the bond matures. The coupon rate is determined by the issuing company when the bond is issued and remains fixed throughout the bond's life.

Difference Between Coupon Rate and Discount Rate (With Table) Securities with low coupon rates will have higher Discount rate hazards than securities that have higher coupon rates. Loan Process: If the financial backer buys an obligation of 10 years, of the assumed worth of $1,000, and a coupon pace of 10%, then, at that point, the bond buyer gets $100 consistently as coupon installments on the bond.

What is coupon for bond

Zero Coupon Bond Funds: What Are They? - The Balance A zero coupon bond is a bond that doesn't offer interest payments but sells at a discount—a price lower than its face value. 1 The bondholder doesn't get paid while they own the bond, but when the bond matures, they will be repaid the full face value. Zero coupon bond funds are funds that hold these types of bonds. What Are Bonds and How Do They Work? Examples & FAQ Her coupon/bond yield of $50 (calculated with the coupon rate of 5% interest) So, in the end, her bond had a total coupon/bond yield of $100. Jessica's profit is directly proportional to the ... Bond Yield: Definition & Calculation with Interest Rates Coupon rate: the bond's interest rate which is a percentage of the bond's face value; for example, if a bond has a coupon rate of 5% and a face value of $1,000, it will pay $50 in interest annually

What is coupon for bond. What is meant by bond washing transaction? A coupon payment on a bond is the annual interest payment that the bondholder receives from the bond's issue date until it matures. For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it pays total coupons of $50 per year. What is itr2? What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, bond issuers (governments and corporations) reward bondholders (investors) with interest payments called "coupons" over the course of a bond's term before returning the principal amount,... Zero coupon bond definition — AccountingTools January 15, 2022 What is a Zero Coupon Bond? A zero coupon bond is a bond with no stated interest rate. Investors purchase these bonds at a considerable discount to their face value in order to earn an effective interest rate. An example of a zero coupon bond is a U.S. savings bond. Disadvantages of Zero Coupon Bonds What Is a Coupon Payment? - Smart Capital Mind A coupon payment is a payment made to the holder of a bond for the interest that bond accrues while it is maturing. This is typically made as a semi-annual payment, so only half of the interest owed on the bond is paid at a time.

What Is a Zero-Coupon Bond? | The Motley Fool Zero-coupon bonds are debt securities that are sold at deep discounts to face value. As their name indicates, they don't pay periodic interest payments, but they do reach full maturity at a certain... Coupon Rate Calculator | Bond Coupon A coupon is the interest payment of a bond. Typically, it is distributed annually or semi-annually depending on the bond. We usually calculate it as the product of the coupon rate and the face value of the bond. How often do I receive coupons from investing in bonds? The short answer is it depends on the bonds that you invest in. What is zero coupon bonds? - myITreturn Help Center Zero-coupon bond (also discount bond or deep discount bond) is a bond bought or issued at a price lower than its face value and the face value repaid at the time of maturity. It does not make periodic interest (coupon) payments. Hence the term is called as zero-coupon bond. Coupon bond definition — AccountingTools What is a Coupon Bond? A coupon bond has interest coupons that the bond holder sends to the issuing entity or its paying agent on the dates when interest payments are due. Interest payments are then made to the submitting entity. The interest coupons are normally due on a semi-annual basis.

Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond ... What Is Coupon Rate of a Bond - The Fixed Income A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment. Bond Yield: Definition, Formula, Understanding How They Work The coupon yield — or coupon rate — is the interest you earn annually from a bond. For example, if you bought a bond for $100 and earned $5 in interest per year, that bond would have a 5% ... What Is the Coupon Rate of a Bond? A coupon rate is the nominal or stated rate of interest on a fixed income security, like a bond. This is the annual interest rate paid by the bond issuer, based on the bond's face value. These interest payments are usually made semiannually. This article will discuss coupon rates in detail.

Are Bonds Taxable? 2022 Rates, Types of Bonds, Tax-Minimizing Tips The rate you'll pay on bond interest is the same rate you pay on your ordinary income, such as wages or income from self-employment. There are seven tax brackets, ranging from 10% to 37%. So if...

Coupon Rate - Meaning, Calculation and Importance The bond's coupon rate refers to the amount of annual interest the bondholder receives from the bond's issuer. Coupon rates are a percentage of the bond's face value (par value) and are set while issuing the bond. Moreover, the coupon payments are fixed for a bond throughout its tenure.

Bond Definition: What Are Bonds? - Forbes Advisor A bond's face value is also the basis for calculating interest payments due to bondholders. Most commonly bonds have a par value of $1,000. Coupon: The fixed rate of interest that the bond issuer...

Zero Coupon Bond: Definition, Formula & Example - Study.com A zero coupon bond is a type of bond that doesn't make a periodic interest payment. In bond investing, the term 'coupon' refers to the interest rate repaid periodically to the bondholder.

Russia Readies New Bond-Payment Plan in Bid to Avoid Default Ozon had warned of bond payment issues in early March and has since entered into discussions with an ad hoc group of holders of its $750 million, 1.875% unsecured convertible bonds.

Zero Coupon Bond | Definition, Formula & Examples - Video & Lesson ... Coupon Bond Definition: A coupon bond is also a debt obligation with various coupons attached to it. This is to represent the different periodic payments, usually semiannual, between its issuance...

5 Safest Zero Coupon Bond in India - Bondsindia Forum A zero-coupon bond will usually have higher returns than a regular bond. List of safest zero coupon bonds in India 2022. A zero coupon bond is a debt instrument wherein the issuer does not make any coupon payment but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face ...

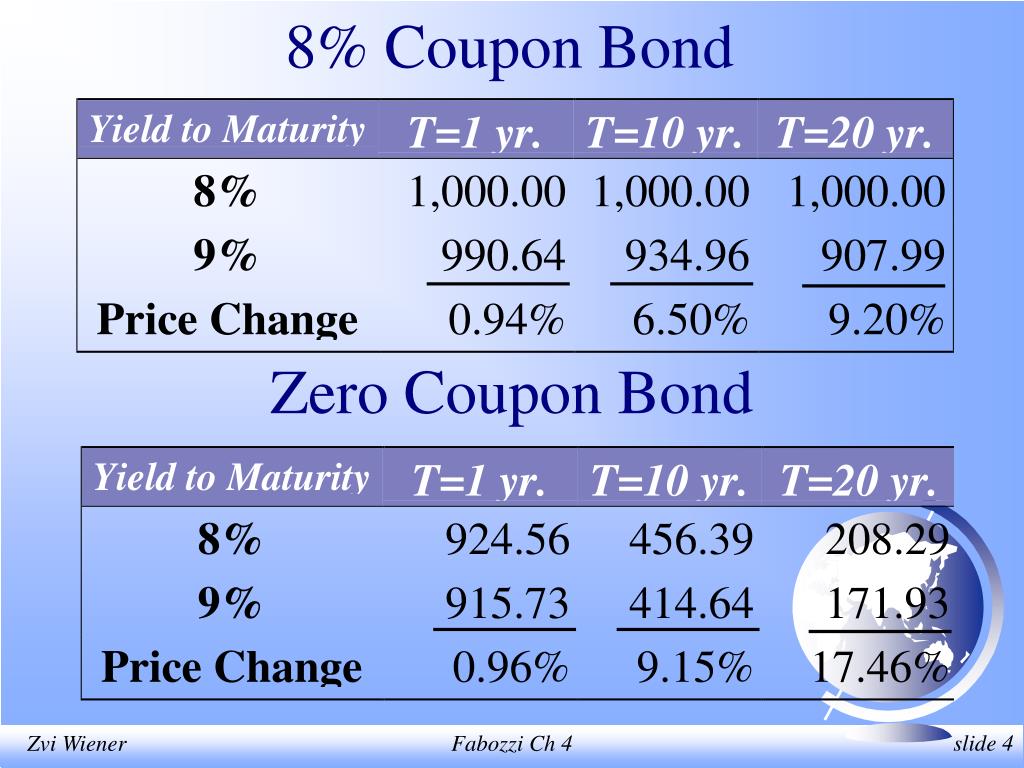

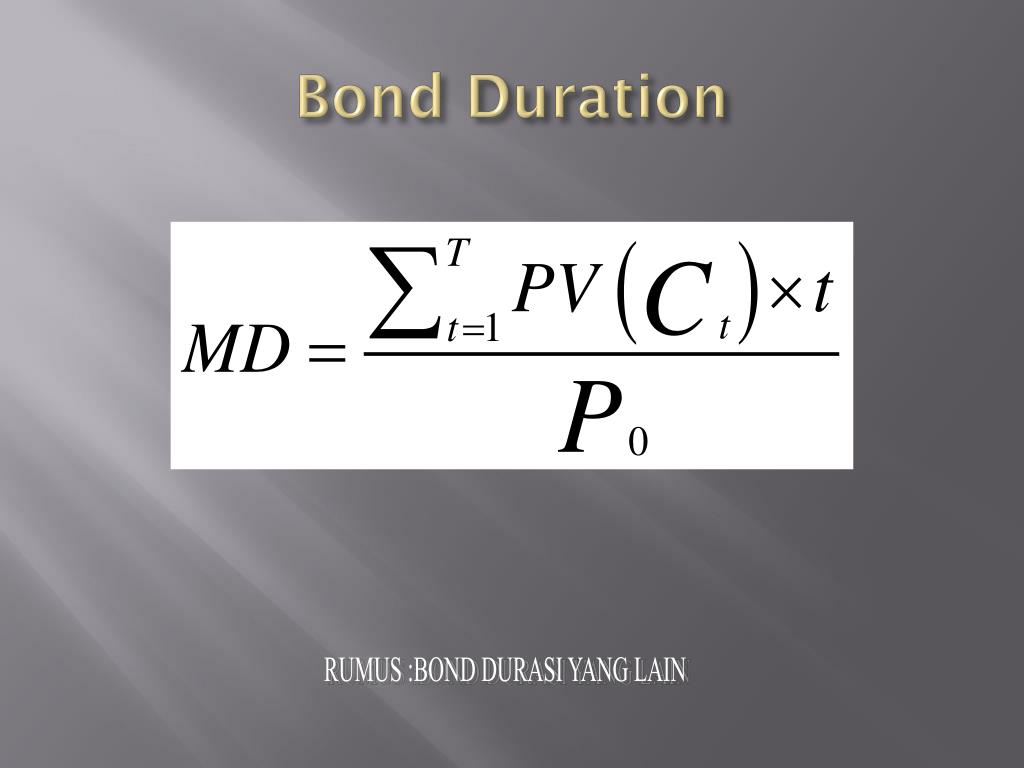

Zero Coupon Bond - Explained - The Business Professor, LLC Calculating the Price of a Bond. Below is the formula for calculating the present value of a zero coupon bond: Price = M / (1 + r)^n where M = the date of maturity r = Interest Rate n = # of Years until Maturity If an investor wishes to make a 4% return on a bond with $10,000 par value due to mature in 2 years, he will be willing to pay ...

Russia makes Eurobond coupon payments in FX - settlement depository Russia's National Settlement Depository (NSD) on Friday successfully paid coupons in foreign currency on two Eurobonds, an NSD representative told Reuters, a move that could mean Russia may have ...

What are Bonds - Meaning, Types, Key Terms & How to Invest c. Zero coupon bond: Zero coupon bonds do not pay coupon (interest). Instead, they are issued at a discount to their face value and redeemed at par. The difference between the two prices is the investors profit. For example, a bond is issued at Rs 80 and redeemed at Rs 100. The difference of Rs 20 is the bondholder's profit.

Explain Bonds, Bond Terms, Price and Yield, Types of Bond Risk - Arbor Asset Allocation Model ...

Bond Yield: Definition & Calculation with Interest Rates Coupon rate: the bond's interest rate which is a percentage of the bond's face value; for example, if a bond has a coupon rate of 5% and a face value of $1,000, it will pay $50 in interest annually

What Are Bonds and How Do They Work? Examples & FAQ Her coupon/bond yield of $50 (calculated with the coupon rate of 5% interest) So, in the end, her bond had a total coupon/bond yield of $100. Jessica's profit is directly proportional to the ...

Zero Coupon Bond Funds: What Are They? - The Balance A zero coupon bond is a bond that doesn't offer interest payments but sells at a discount—a price lower than its face value. 1 The bondholder doesn't get paid while they own the bond, but when the bond matures, they will be repaid the full face value. Zero coupon bond funds are funds that hold these types of bonds.

Post a Comment for "40 what is coupon for bond"